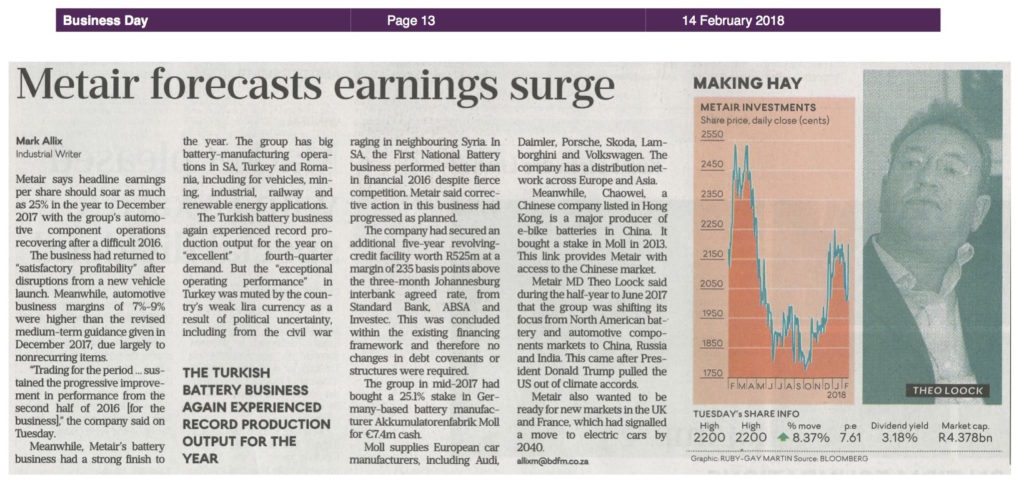

Metair says headline earnings per share should soar as much as 25% in the year to December 2017 with the group’s automotive component operations recovering after a difficult 2016.

Metair says headline earnings per share should soar as much as 25% in the year to December 2017 with the group’s automotive component operations recovering after a difficult 2016.

Die nywerheidsgroep Metair verwag ‘n stewige verbetering in sy vertoning vir die boekjaar tot einde Desember 2017.

Die nywerheidsgroep Metair verwag ‘n stewige verbetering in sy vertoning vir die boekjaar tot einde Desember 2017.

JSE Listed Metair Investments expects headline earnings per share for the year ended December 2017 to be 20.6% – 24.6% higher than in the previous corresponding period.

JSE Listed Metair Investments expects headline earnings per share for the year ended December 2017 to be 20.6% – 24.6% higher than in the previous corresponding period.

JSE-listed Metair expects to report a 24.6% year-on-year increase in headline earnings a share for the year ended December 31, while earnings a share are likely to be between 21.6% and 25.5% higher year-on-year.

“The automotive component vertical recovered after a difficult 2016, returning to satisfactory profitability after the disruption of the new vehicle launch. Trading for the period, therefore, sustained the progressive improvement in performance from the second half of 2016,” Metair said in a trading statement on Tuesday.

The company expects to see mid-single-digit full year turnover growth, and to achieve profit before interest and tax (PBIT) margins of about 10% for the full year.

Metair maintained its medium-term guidance that the achievement of targeted production volumes and efficiencies associated with the new technology and stabilisation of manufacturing processes should result in medium-term PBIT margins on new business of between 7% and 9%.

The company’s energy storage vertical has seen traditionally strong seasonal volume demand in the winter markets served by Rombat and Mutlu Akü in Europe and the Middle East, supported by a strong performance from Mutlu Akü, partially offsetting the impact of depreciating foreign currencies and higher lead prices.

Despite the negative impact of currency translation, the energy storage vertical is expected to achieve an improvement in PBIT of about 6%, with margins remaining stable at around 9.5%.

Metair’s Turkish battery business experienced record production for the year on the back of excellent fourth-quarter demand. The exceptional operating performance was, however, muted by the weak Turkish lira as a result of political uncertainty.

Metair’s South African operation, First National Battery, improved its performance in the face of increased competition after corrective action progressed as planned.

The company will announce its financial results on March 15.

Enginnering News

By Anine Kilian, 13 February 2018

http://www.engineeringnews.co.za/article/metair-expects-to-report-positive-growth-in-fy17-headline-2018-02-13

Vehicle parts maker Metair’s share price rose 6.2% to R21.55 on Tuesday morning after it released an upbeat trading statement.

Metair said it expected to report on March 15 that headline earnings per share (HEPS) for the year to end-December grew by up to 24.6%.

The group splits itself into an “energy vertical”, specialising in batteries and which has expanded geographically; and a “components vertical”, which suffered during the first half of the financial year due to teething problems from new product launches.

Metair said its Turkish battery business enjoyed record production and high demand, but suffered from Turkey’s political uncertainty causing the lira to weaken.

The group’s Romanian battery business also suffered from the lei weakening against the rand.

Its South African operation, First National Battery, improved its performance in the face of high competition after “corrective action progressed as planned”.

The group’s component division is expected to achieve turnover growth in the mid single digits, following an improved performance in the second half of the financial year.

“The major improvement in performance was at Hesto Harnesses specifically, which improved from a loss position in 2016,” Metair said.

The group had secured a R525m five-year revolving credit facility, paying interest of 235 basis points above three-month Johannesburg interbank agreed rate (Jibar), from Absa and Investec, the trading statement said.

Business Day

By Robert Laing, 13 February 2018

https://www.businesslive.co.za/bd/companies/industrials/2018-02-13-metairs-upbeat-trading-statement-sends-shares-higher/

Energy storage and automotive component specialist Metair has launched a programme to produce lithium-ion (li-ion) batteries across its operations in South Africa, Turkey and Romania.

The programme will see Metair partner with universities and industry agencies for the production and certification of li-ion batteries.

Historically, Metair used available li-ion solutions from upstream suppliers to deliver customer-specific systems and solutions, adding only its own system design and controls.

This, however, is set to change.

In South Africa, Metair will partner with the South African Institute for Advanced Materials Chemistry (SAIAMC), located at the University of the Western Cape (UWC), which houses the only pilot scale li-ion battery cell assembly facility in Africa.

Metair’s agreement with UWC will see the company invest R3-million over three years to pilot a prototype lithium production project from January, to improve equipment and to sponsor one local post-doctoral fellow to be trained at Argonne National Laboratory, in the US.

Production will focus on mining cap lamp cells, 12 V li-ion automotive batteries, 48 V li-ion batteries for energy storage applications and solar panel recharge technology.

“Energy storage is a major focus area for many industries globally,” explains Metair MD Theo Loock.

“South Africa was at the forefront of li-ion battery technology and we believe that this should remain the case as the global transition towards electric vehicles and renewable sources of energy drive the requirement for increasingly sophisticated energy storage solutions that rely on locally sourced raw materials and production facilities to reduce costs.”

The local partnerships, such as the one with UWC, will provide a platform for Metair to validate its local solutions on a regular basis as the global production of electric vehicles accelerates.

Metair will, however, also continue to use internationally recognised li-ion chemistry solutions and apply specific design and controls for customers.

Manganese in Abundance

“In South Africa, we will invest and work closely with UWC to deliver a locally validated li-ion solution for mining cap lamp applications using the most efficient chemistry mix based on widely available local minerals, such as manganese, to support local beneficiation,” says Loock.

“Our relationship will ensure that the testing and validation of the technology is undertaken according to strict academically driven standards, but [will] also support local human capital development as more students become involved in this process – alongside government and private companies – looking to develop commercially viable local production of li-ion solutions.”

South Africa is home to more than 80% of the world’s manganese, which is one of the main commodities required in the manufacturing of li-ion batteries, together with elements such as iron, nickel and fluor.

Most electric vehicles today use li-ion battery packs, the same technology that powers laptops,smartphones and tablets.

Metair believes that sustained research and development initiatives to support local production with locally available commodities will drive down costs.

“Metair continues to position itself to take advantage of changing technological trends, especially in our energy storage vertical, where the market conditions and dynamics are subject to technology shifts which include the mass introduction of electric vehicles,” notes Loock.

Engineering News – By Irma Venter

Die nywerheidsgroep Metair vat hande met universiteite in Suid-Afrika, Roemenië en Turkye om plaaslike intellektuele eiendom te benut.

Die groep wat onder meer motorbatterye vervaardig, sê in ’n verklaring hy stel ’n program bekend om litium-ioon (LiIon)-batterye in die drie lande te produseer wat plaaslike grondstowwe en intellektuele eiendom sal benut.

Vennootskappe word met plaaslike universiteite en bedryfsagentskappe gesluit om produksie en sertifisering te doen.

“Dit is ’n belangrike skuif vir Metair wat altyd beskikbare LiIon-oplossings van verskaffers verder aan in die vervaardigingsketting verkry het,” sê die groep in ’n verklaring. In Suid-Afrika sal Metair saam met die Universiteit van Wes-Kaapland (UWK) werk waar die South African Institute for Advanced Materials Chemistry (SAIAMC), die enigste gidsprojek vir die vervaardiging van LiIon-batteryselle in Afrika het.

Ingevolge die vennootskap met Metair sal die maatskappy R3 miljoen oor die volgende drie jaar investeer om die prototipe litiumproduksie van Januarie volgende jaar te begin.

Produksie sal op produkte soos selle vir mynkoplampe, LiIon-motorbatterye en batterye vir die herlaai van sonkragpanele fokus. Die opberging van energie is ’n belangrike fokusgebied vir baie internasionale bedrywe, sê Theo Loock, uitvoerende hoof van Metair. “Suid-Afrika is aan die voorpunt van die LiIon-tegnologie vir batterye.

Ons glo dit moet gehandhaaf word gegewe die internasionale verskuiwing na elektriese voertuie en hernubare energiebronne wat op plaaslike grondstowwe en produksiegeriewe staatmaak om koste te verminder.”

Netwerk24 – deur Vida Booysen

https://www.netwerk24.com/Sake/Maatskappye/metair-en-uwk-se-projek-hou-sa-aan-voorpunt-20171127#Metair is ready for the anticipated revolution in the automotive industry, including the introduction of electric vehicles (EVs), hybrid vehicles and autonomous drive vehicles.

These vehicles still need lights, brakes and wiring harnesses, for example, said Metair MD Theo Loock at the announcement of the company’s financial results in Johannesburg last month.He added that EVs may use lithium-ion batteries to power them, but they also used normal lead-acid batteries for their control systems.

“And that’s not going to change,” said Loock. “Our EV adaptibility is high. The plan is to EV-proof the business.”

The JSE-listed Metair is an international manufacturer, distributor and retailer of energy storage solutions and automotive components.

It owns or has a shareholding in battery production sites in Romania, Turkey, South Africa, China and Germany. A big focus of current battery production includes start-stop batteries. Components manufacturing is undertaken mainly in South Africa, and includes wiring harnesses, lighting, heat exchange products, plastic products and ride control products. Metair is not currently a producer of lithium- ion batteries as the main power source for EVs. However, the company already produces lithium-ion starter batteries in Turkey. The batteries Metair made were 12 V batteries used for control applications, and were not used as the vehicle’s main energy source, explained Loock.

Around 30% of Metair’s mining cap lamp production in South Africa was also lithium- ion batteries, he added. “We are like Tesla. We buy the cells. We are not into chemistry. We do battery management, packaging and we provide solutions.”

Loock said Metair would, over time, “and at the right time”, look to increase lithium-ion battery production and move into the production of lithium-ion batteries used as the main power source in EVs.

“This, however, would be tied to a specific contract and vehicle manufacturer. It will probably also be in alliance with a reputable global battery producer.”

Any further global expansion by the company in terms of geographic footprint would be to the East, noted Loock, and no longer the US.

The trend used to be that European and US emission legislation tracked each other closely. However, the emergence of Trumponomics had changed the US’s stance towards emissions, he said. “We have received several requests for technical assistance from India, Russia and China.”

Diesel First Casualty in SA Exports

Increasingly stringent emissions legislation in Europe might take the scalp of diesel vehicle exports from South Africa to Europe within the next ten years or so, predicted Loock.South Africa exported around 196 000 vehicle into Europe in 2016. It is not clear how many of these are diesel derivatives.

The timeline for technology changes were fluid and would vary between different markets, commented Loock.

The Numbers

Metair reported a 1% gain in revenue for the six months ended June 30 to R4-billion, compared with the same period last year. Operating profit increased by 36% to R355-million.The gains followed largely on the back of a recovery in the Automotive Components business, following the elimination of new-vehicle- model launch support costs and improvements in efficiencies.

“The group has delivered an excellent performance in an exciting and very dynamic environment,” said Loock. He added that the technology shift currently seen in the automotive market, including “the possible accelerated mass introduction of electric vehicles”, had led to a refinement of the group strategy, which was to produce 50-million batteries across five continents over five years.

The focus was now for the Energy Storage business to become the world leader in the supply of energy source products used in control and energy solutions across the full spectrum of mobility options and to nurture the Automotive Components business with participation in selected growth opportunities.

“We want to address the fear that we have a sunset technology in our business,” said Loock.

By: Irma Venter – Creamer Media Senior Deputy Editor – Engineering News

- Operating profit was 36% higher at R355 million while operating margins improved to 8.71%

- Headline earnings per share (HEPS) rose 111% to 114 cents

- A dividend of 70 cps has been declared for the period ending 30 June 2017

- Automotive Components vertical stabilised following elimination of new vehicle model launch support costs and improvement in efficiencies

- Energy Storage Vertical showed resilience and despite socio and geopolitical challenges, successfully recovered currency and commodity price pressures from the market

- Group strategy enhanced as Metair strives to become the leading market player in energy solutions for the full mobility spectrum

17 August 2017 – Metair, a leading international manufacturer, distributor and retailer of energy storage solutions and automotive components, today announced a robust set of results for the six months to 30 June 2017.

Group revenue increased marginally to R4.08 billion while group operating profit rose 36% to R355 million. EBITDA was 35% higher at R527 million with headline earnings per share improving 111% to 114 cents.

Theo Loock, Metair’s Managing Director commented: “The group has delivered an excellent performance in an exciting and very dynamic environment.

“Metair remains well positioned to take advantage of changing technological trends, especially in our Energy Storage Vertical, where the market conditions and dynamics are subject to technology shifts in the mobility market, particularly the possible accelerated mass introduction of electric vehicles.”

These changes have led to a refinement of the group strategy which is to produce 50 million batteries across five continents over five years.

Accordingly, the strategy for the Energy Storage Vertical is to become the world leader in the supply of energy source products used in control and energy solutions across the full spectrum of mobility options and to nurture the Automotive Components Vertical with participation in selected growth opportunities.

Additionally, together with its partners, Metair is developing and deploying leading technology for niche applications at the front end of the technology curve but also extending its existing technology backwards into large developing markets.

“There is no doubt that there is disruption and change in our markets but Metair is very well positioned to capitalise on these changes.

“We have enhanced our globalisation strategy as we strive to become the leading market player in energy solutions for the full mobility spectrum which opens up new markets and opportunities.

“The foundation to achieve our strategy has already been laid through various technology advancements and strategic acquisitions made in recent years including our most recent investment in Moll, a German battery manufacturer and supplier which provides access to Europe and Asia as well as different mobility products and technologies,” concluded Loock.The Automotive Components businesses stabilised following the elimination of premium support costs as well as costs associated with volume ramp up complexities and variable manufacturing activity linked to the launch of a new light commercial vehicle by a major customer. The business achieved 11.1% turnover growth while profit before interest and tax (PBIT) margins were 9.3% as a result of the manufacturing and volume stability achieved. The stronger South African rand also provided short term currency gains on imported materials and components.

The Energy Storage Vertical showed resilience despite operating currency weakness, higher commodity prices, and pressure to recover pricing in the market. The business attained PBIT growth of 18% excluding the negative impact of currency translation. Overall margins rose slightly as a result of an improved performance from the South African battery business, a satisfactory local operating performance from Turkey and an increase in higher margin export business from both Turkey and Romania.

Looking forward, the improvement in first half results should support a sustained performance for the full year when compared to 2016, as the seasonally stronger half in the Energy Storage Vertical is muted by the full year impact of the Turkish Lira devaluation. The Automotive Component Vertical managed to successfully renew most of its business associated with the new model launches, underpinning the next business cycle linked to the new model launches. The Energy Storage Vertical should benefit from strong seasonal demand in its winter markets and some geopolitical stability in Turkey while the South African market is expected to show moderately improved trading conditions.

ENDS

Enquiries:

Instinctif Partners +27 (0)11 447 3030

Louise Fortuin + 27 (0)71 605 4294

Gift Dlamini +27 (0)82 608 6587

Notes to Editors:

About Metair:

Metair Investments Ltd (Metair) is a publicly owned company listed on the Johannesburg Stock Exchange. The group is headquartered in Johannesburg and manages an international portfolio of companies that manufacture, distribute and retail products for its energy storage and automotive component verticals, exporting to approximately 46 countries.

The group’s operations manufacture, assemble, distribute and retail energy storage products and automotive components in Africa, Europe, Turkey, the Middle East and Russia.

Energy storage

The energy storage segment manufactures batteries for automotive, telecoms, utility, mining, retail and materials/products handling sectors. Automotive batteries are mainly supplied to the aftermarket through Metair’s unique aftermarket distribution channels and franchised retail networks, and are supplied to automotive original equipment manufacturers (OEMs).

Aftermarket products are also exported to approximately 46 destinations across Africa, Europe, the Middle East, Russia and Turkey. Non-automotive products are mainly sold into sub-Saharan Africa and Turkey.

Metair supplies batteries to all major OEMs in South Africa, Europe, Romania, Turkey and Russia through subsidiaries in Romania (Rombat), Turkey (Mutlu Akü) and South Africa (FNB). Key territories include Romania, Russia, South Africa, Turkey and Slovakia.

Automotive components

Automotive components include original equipment (OE) components used in the assembly of new vehicles by OEMs as well as spare parts and other products used in the automotive aftermarket. These include brake pads, shock absorbers, lights, radiators and air conditioners. The group also produces generic aftermarket products for use in the increasing number of imported vehicles.

For more information on Metair and the group’s subsidiaries please visit the website at: www.metair.co.za